By John Otterbein | Thu, August 13, 15

We know the future will be bright for the residential lighting market, but just how efficient will it be?

Residential lighting has long been at the heart of ratepayer-funded energy efficiency program portfolios. In New England, residential lighting measures have produced over 30 percent of all efficiency program savings. The large savings potential along with the relatively low barriers to getting bulbs into sockets makes lighting the classic low hanging fruit.

So it comes as no surprise that since the late 1980s, program administrators from Maine to Maryland have designed and implemented large programs that educate consumers on new products, leverage the latest in lighting technology, target hard-to-reach customer segments, save consumers money, and lower carbon emissions.

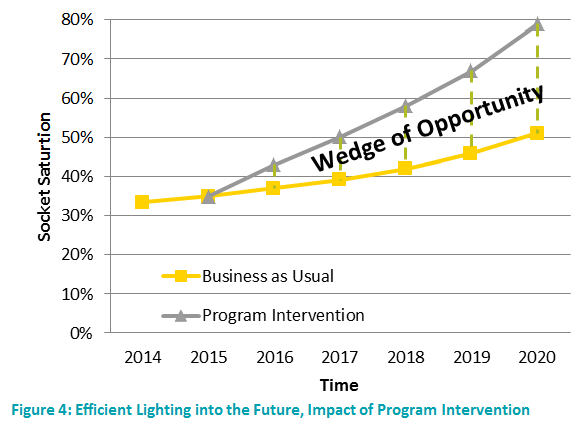

It’s known far and wide that more efficient lighting technologies, like LEDs and CFLs, are the prudent and proper way to light a home. However, these highly-efficient lighting technologies still require additional assistance from utility-administered residential lighting programs and tightening federal appliance standards, like EISA, if the residential lighting market is to reach a complete transformation.

A companion piece to our suite of annual Residential Lighting Strategies, The State of Our Sockets: A Regional Analysis of the Residential Lighting Market, sets out to answer a series of questions pertaining to the current state of the residential lighting market, such as:

- Has the residential lighting market been transformed?

- Where is the market headed? What impacts will EISA 2020 have?

- Is there a role for residential lighting programs in the current environment?

- What are the long and short term priorities?

Based on our assessment of the current state of the market, and bolstered by regional stakeholder input, we conclude that the residential lighting market is not fully transformed and recommend strong support for the continuation of residential lighting efficiency programs in the near term. This analysis is intended to bring attention to the progress that has been made in the transformation of the residential lighting market and provide education on various factors that will likely impact the market in the years ahead. Residential lighting is a complex category and not just composed of general service lamps; it is our hope that the impacts of all phases of EISA are made clearer through this document. Our key findings are summarized as follows:

-

Outdated Bulbs are Still Rampant

Inefficient lighting still fills the majority of sockets in the Northeast. It is clear that the residential lighting market has NOT been transformed. Policy makers should set their sights on the remaining opportunity to fill most sockets with efficient lighting.

-

Efficiency Programs Should Continue Full Steam Ahead

There is a great opportunity for efficiency programs to remain engaged with the entire residential lighting market to achieve significant cost-effective energy saving in the next three years and in the process, drive a complete regional market transformation of residential lighting.

-

EISA has Two Phases Left

EISA 2020 has the potential to eventually drive market transformation of general service lighting, but it will not be effective until 2020; there continue to be opportunities for intervention in the short term.

-

EISA Needs Additional Support

There are many potential challenges to EISA 2020 moving forward. Regional Stakeholders should support a strong final rule of 45 lpw or greater with reduced exemptions. This standard would help drive market transformation for most general service lamps, a major category in residential lighting.

-

EISA Should Continue to Work In Concert with Strong Programs

EISA 2020, even with a favorable result, will not be a silver bullet to drive complete market transformation of residential lighting. The scope of EISA only applies to one-third of the lamp types in homes. In the long term, programs still may have a significant role to play for products exempted or excluded from EISA 2020.

-

Data Access is Crucial

As efforts continue in this space, there is a strong need for better and more consistent data to track progress to allow policy makers and program administrators to make more informed decisions. While NEEP will prioritize tracking the transformation of the residential lighting market in the years to come, regional stakeholders should assist this effort by collecting consistent market data using consistent methodologies.

NEEP stands ready to assist the transformation of this lighting market by developing regional market transformation strategies and market progress reports to track market movement and inform modifications to strategy elements. NEEP invites interested stakeholders to join the ongoing Residential Lighting Strategy process to get involved with these efforts and to look out for:

- The forthcoming update to the Residential Lighting Strategy, expected in the Fall 2015