By Aditi Dalal | Mon, November 21, 22

As temperatures approached record highs this summer, the passage of the Inflation Reduction Act (IRA or Act) brought hope for an actionable future. It set the United States on a course to reduce greenhouse gas (GHG) emissions by 40 percent by 2030, and represents one of the most significant climate investments ever made by the federal government. From loans to grants to tax credits, the IRA will allow states, local governments, non-profits, tribes, and households to take action in reducing emissions by investing in energy efficiency upgrades, weatherization, workforce initiatives, and much more. The Act prioritizes equity within its investments through creating programs specifically targeted to low- and moderate- income customers and marginalized communities.

Despite this historic investment, many questions still remain – How will these programs be implemented? How can states and other entities be prepared to take advantage of these benefits? What types of projects qualify for this new funding?

NEEP held a webinar, Preparing for IRA Funding, to start this discussion and invited industry experts to talk about available programs, ways to center equity, and how business can take actions now to prepare for implementation later. Below is an overview of the highlights from this discussion.

Incentives and Rebates in the IRA

Here are the grants available from the IRA. For more details about IRA funding, see NEEP’s IRA Policy Fact Sheet.

- $1 billion in codes grants for state and local governments. $330 million to adopt the most recent energy code and $670 million to adopt the zero energy provisions of the 2021 IECC building codes.

- Almost $9 billion in rebates for commercial and residential buildings through two programs.

- The Home Own Managing Energy Savings (HOMES) rebate directs $4.3 billion to states energy offices for whole-home retrofit packages based on the reduction in home energy use.

- The High Efficiency Electric Home Rebate Act (HEEHRA) provides $4.5 billion to state energy offices to fund efficient electrification in low- and moderate- income households.

- $200 million for a statewide workforce training program to support energy efficiency and electrification contractor training.

- The Greenhouse Gas Reduction Fund allocates $27 billion to the Environmental Protection Agency (EPA) to fund clean energy infrastructure projects with low-cost financing.

- Numerous tax deductions incentivizing individuals and businesses to adopt efficiency and clean energy technology on their own. More information about criteria is available in NEEP’s IRA Policy Fact Sheet.

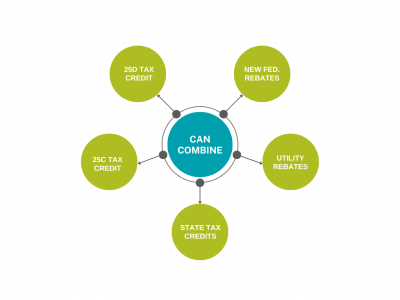

- For residential home owners, The Energy Efficient Home Improvement Credit (25C) allows households to deduct up to 30 percent of the cost of weatherization and energy efficiency upgrades. The Residential Clean Energy Credit (25D) allows homeowners to deduct part of the cost (30 percent until 2032, 36 percent in 2033, and 22 percent in 2034) of installing solar panels, ground source heat pumps, solar water heaters, and battery storage systems.

- For businesses, the Commercial Buildings Energy Efficient Tax Deduction (179D) credit offers $2.50 to $5.00 per square foot for owners of new or existing buildings that reduce their energy use intensity by 25-50 percent. The Commercial and Utility Renewable Energy Investment Tax Credit (48) provides a minimum 30 percent investment tax credit for commercial geothermal heat pumps.

- For residential new construction, The New Energy Efficient Home Credit (45L) offers tax credits to developers who build homes meeting certain energy performance criteria as qualified by the Department of Energy. It includes new single and multifamily homes, manufactured homes, and existing homes going under deep retrofits.

How to Prepare

-

Coordinate with Stakeholders Such as Utilities, Program Implementers, and Community Agencies to Identify State Needs and Implementation Pathways: Different entities implement energy efficiency programs within states and have the potential to receive funding. States can begin to coordinate with these various actors now to streamline program implementation. This will allow states to gain a better understanding of what resources already exist, where they can leverage IRA funding to complement current state initiatives, and what roles different stakeholders will serve.

-

Remove Barriers in Current Regulatory Structures to Accelerate Implementation: IRA rebates and incentives focus on implementing weatherization and electrification measures with specific intent to serve low- and moderate- income communities. Regulatory structures already in place tend to prioritize near term, low-cost savings over these measures and could deter investment if states do not address them. States could consider modifying cost-benefit requirements for programs, changing program metrics and targets, and modifying the implementation structure low- and moderate income programs.

-

Identify Ways to Address Common Barriers to Participation for Underserved Communities: The IRA has incentives and rebates designed to provide benefits to low- and moderate- income residents, yet funding is not the only barrier to participation for underserved communities. To help increase adoption, states could explore additional initiatives to address common barriers to participation such as deferrals and the landlord-renter split incentive. Additionally, states can take time now to identify ways to braid funding and create programs that offer a wide variety of services to address energy efficiency, health, and other needs.

-

Work With Energy Efficiency Companies and Utilities to Identify Workforce Training Needs and Certifications: Designing workforce programs with purposeful initiatives can provide access to opportunities and bring a more diverse coalition of workers and contractors together to deliver programs. Identifying state workforce needs now can help determine how to best use funds to grow the workforce and complement existing efforts.

-

Center Equity in Program Design and Implementation: To ensure that underserved communities receive the benefits of the IRA, it is important to take steps now to center equity through initiating a stakeholder process, creating a plan to address known barriers in program implementation, and identifying metrics to measure performance through an equity lens. Now is the time to identify how programs can look to remediate past harms by centering community needs and ensuring purposeful investment efforts.

Conclusion

The Inflation Reduction Act offers a generous amount of funding for states, local governments, tribes, non-profits, and individuals to take action in creating a more efficient future. By working together, all entities can ensure that the country reduces its emissions by 40 percent by 2030. To learn more about how to leverage this funding in your state and community, check out the different resources NEEP has to offer, including a Federal Funding Resources page, an IRA Fact Sheet, and a webinar on Preparing for IRA Funding.