By Bryan Evans | Fri, July 23, 21

Often time, when a blog or discussion is centered on the word “mortgage,” my brain automatically signs off. Let’s face it, mortgages are complex and boring, which is sometimes a recipe for disaster.

It's strange, then, that my latest blog is about mortgages. This is no ordinary mortgage blog, though – it’s a blog about energy mortgages.

Most of you reading this may have already committed to a 30-year mortgage, a 2-5 year car lease, maybe even a long-term gym membership and yet still apprehensive about committing to energy improvements. Is it because of the costs, the paperwork, a lack of knowledge on what to do? Whatever the reason, we have a solution for you: Vermont’s EnergyFirst Mortgage.

Energy efficient mortgages are the most cost effective way of retrofitting homes and reducing operating costs. However, lenders and borrowers don't often take time during the lending process to research a home’s energy performance. Energy is virtually invisible in the residential mortgage market:

- Home buyers rarely know their expected energy costs

- Appraisers don’t understand how to value energy performance

- Sellers and their real estate agents don’t want to complicate the sales process

- Lenders don’t have access to this information in order to help buyers improve a home’s energy performance

To address this problem, a group of partners consisting of Energy Futures Group, the Vermont State Employees Credit Union (VSECU), and others developed and launched the “EnergyFirst Mortgage”. This mortgage product provides a discounted interest rate to homeowners in two counties in Vermont looking to make energy improvements – such as home weatherization, heating system updates, and/or a solar photovoltaic installation – as part of their refinancing process. VSECU offers up to 30-year fixed rate mortgage loans with a ½ percent interest rate reduction and, in return, customers must invest at least 10 percent of the loan into energy improvements. Some additional features include:

What's the Investment Worth?

To help visualize the guaranteed savings, the table below shows an example. By borrowing 10 percent more and receiving a ½ percent interest rate reduction, the mortgage plus energy costs will be about the same or slightly less than if no upgrades were done. The difference is that, as a result of the upgrades, a home is more comfortable, healthy, sustainable, and valuable.

In fact, Freddie Mac researched the impact of energy efficiency on home values and found that homes with energy efficient ratings sold for 2.7 percent more than comparable unrated homes, and better-rated homes sold for 3-5 percent more than lesser-rated homes.

|

|

Standard |

VEM |

Difference |

|

Principal |

$250,000 |

$250,000 |

$0 |

|

Energy Improvements |

- |

$25,000 |

$25,000 |

|

Total Loan Amount |

$250,000 |

$275,000 |

$25,000 |

|

Interest Rate |

3% |

2.5% |

-0.5% |

|

Term (Years) |

30 |

30 |

$0 |

|

Monthly Payment |

$1,054 |

$1,087 |

$33 |

|

Annual Payment |

$12,468 |

$13,039 |

$391 |

|

|

|||

|

Annual Energy Costs |

$3,000 |

$2,550 |

($450) |

|

|

|||

|

Total Monthly Operating Cost |

$1,304 |

$1,299 |

($5) |

|

Total Annual Operating Cost |

$15,648 |

$15,589 |

($59) |

Lessons Learned

The Good

Throughout the duration of the pilot (February – June 2021), VSECU received several inquiries about the EnergyFirst Mortgage offering, though many of these potential borrowers were not eligible because they were located outside of the two pilot counties. A handful of others were hesitant about using the contractors available through the pilot because they wanted to use their own contractors.

Additionally, we learned that people are drawn to the EnergyFirst Mortgage because of the opportunity to do home energy improvements at a discounted interest rate. We also found that people are willing to spend more money when incorporating the cost of energy improvements into refinancing compared to tackling standalone energy projects.

Lastly, forming meaningful relationships with implementation partners including energy efficiency programs, credit unions, and contractors goes a long way in securing successful results and demonstrating value for all parties involved.

Room for Improvement

As with any pilot program, the EnergyFirst Mortgage offers an opportunity to test market products and services. This results in room for improvement at various stages throughout the pilot. In this case, two areas to improve include addressing the lack of green appraisers available to do this work and workforce development. The project team identified a few green appraisers, and we are also encouraging non-green certified appraisers to seek certification. Workforce development is always a hot topic and should be further explored to avoid any negative experiences due to an insufficient network of green appraisers and certified home performance contractors.

Furthermore, in previous years, Vermont has piloted Home Energy Score (HES) into its program work and performed around 250 scores. The pilot project incorporated Home Energy Scores into the mortgage process, hoping contractors use the this known value in their recommendations. To ensure a successful HES integration into a mortgage product, program administrators should consider a more simple process that is not so time intensive for auditors.

Looking Ahead

“How come we haven’t been doing this before?” – Member of the VSECU Board of Directors

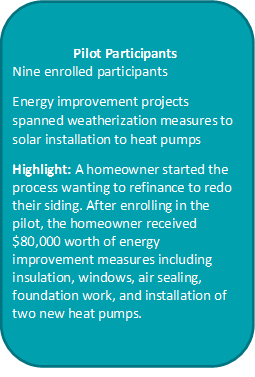

The purpose of the pilot was to demonstrate the feasibility of an energy mortgage model at a small scale through one lender, three contractors, and up to 10 pilot projects. The project enrolled nine pilot project participants throughout the pilot period. With this level of uptake in a relatively short period of time, the project team has been able to show that there is demand for mortgage financing that incorporates home energy improvements. The project indicates that there is high potential for the EnergyFirst Mortgage model to succeed beyond the pilot phase. By securing strong interest from new project partners in New York and Minnesota, and looking to expand statewide in Vermont, we are looking forward to introducing the EnergyFirst Mortgage in new areas, with additional lenders, and evolving features to benefit both borrowers and lenders.