By Erin Cosgrove | Wed, May 24, 23

In April, Connecticut became one of a handful of states to start implementing performance-based rates. Performance-based rates (PBR) align utility profits with public policy goals by changing how utilities invest and make money. In past blogs, we have explored how states can use metrics to pivot program design to include climate and equity goals, and this blog will look at how states can financially incentivize utilities by aligning profits with policy using performance-based rates (PBR).

How Performance-Based Rates Align Utility Goals

Utilities are regulated monopolies that make profits by encouraging customers to use more energy. A regulated monopoly means that while utilities provide essential services for our day-to-day lives, they do not compete with other companies. This lack of competition can lead to poor performance and lack of innovation.

Performance-based rates change how utilities make profits by decoupling profits from sales, and instead tying them to performance. Currently, utility profits are based on capital investments such as pipes and wires infrastructure or power plants and are tied to volumetric sales of electricity, so the more electricity utilities sell, the more profit it can make. With PBR, states can drive investments towards electrification, distributed energy resources, and grid reliability and resilience. Commissions can monitor and reward performance that lowers monthly bills, reduce the frequency and duration of customer outages, and implement electrification measures.

Implementing performance-based rates is a multi-step process with many moving parts. States must first identify goals and objectives, then the types of PBR tools they want to use to align profits with sales. These tools include a revenues adjustment mechanism, such as decoupling profits from sales, and a performance incentive mechanism (PIM) which can reward utilities for meeting certain goals. Below we outline how Connecticut is approaching this process and what to expect next.

Connecticut Takes Back the Grid

Driven by the impacts of climate change, extreme weather, an evolving grid, and state climate policies, Connecticut passed the Take Back Our Grid Act. Among many things, the Act mandates that the state investigate, develop, and adopt a framework to establish accountability for utilities by tying earnings and profits to performance with PBR. In May of 2021, the state regulatory commission kicked off a two-part PBR proceeding. Part 1 looks at what metrics and goals to include and also examines whether current incentives are working as expected. Part 2 identifies the mechanisms to implement PBR and identifies metrics with which to measure progress.

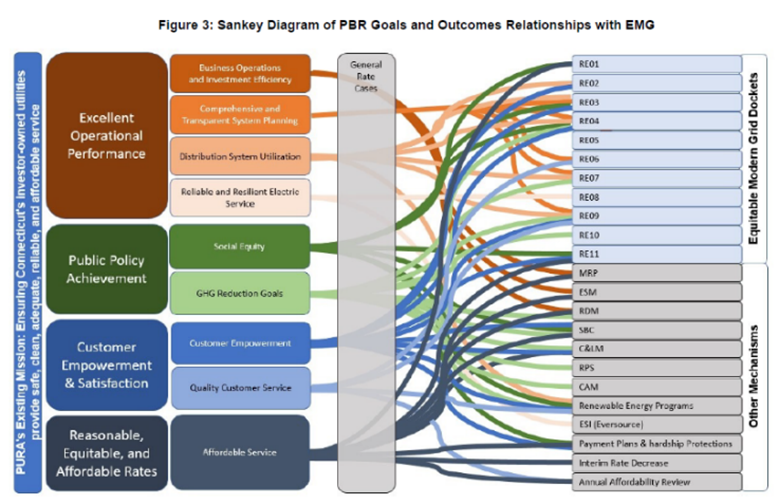

In April 2022, Connecticut released the framework for Phase 1. During that phase, the state identified four regulatory goals, five foundational considerations, and nine priority outcomes to guide future regulations. The considerations and priority outcomes built off the initial four state goals of: excellent operational performance, public policy achievement, customer empowerment and satisfaction, and reasonable, equitable, and affordable rates. In outlining these goals and outcomes, Connecticut also identified how these goals would apply to all current regulatory matters and guide future regulation of utilities. Below is a graphic used to identify how goals link up with proceedings in the state.

Phase 2 of the proceeding will look at and establish different components of a PBR, including decoupling, performance incentive mechanisms, and scorecards to track metrics publicly. The state plans to release a final decision in August of 2024.

A Largely Untapped Resource

While PBR are a valuable tool to change how utilities make money and align profits with public policy, Connecticut is one of a handful of states pursuing and implementing this largely untapped resource. In fact, Hawaii is the only state to adopt a full system of PBRs. Other states, like Massachusetts, use them only for energy efficiency programs.

In Hawaii, the Public Utility Commission (PUC) adopted a performance-based rate for Hawaiian Electric through a stakeholder process similar to Connecticut’s. Under the structure, utilities can earn additional revenue by achieving performance in three key areas: interconnection, low-to-moderate income energy efficiency, and advanced metering infrastructure. The Low-to-Moderate Income (LMI) energy efficiency incentive promotes customer engagement as well as customer equity and affordability by encouraging program administrators to coordinate and increase energy savings opportunities for low- and moderate-income customers.

Other states have adopted a form of performance-based rates for energy efficiency programs only. This can include using tools such as decoupling profits from sales or performance incentive mechanisms (PIMs). PIMs are financial incentives tied to energy efficiency program goals and can result in rewards or penalties depending on utility performance. Massachusetts recently adopted a PIM framework that contained four goals: equity, electrification, value (cost-effectiveness), and a standard component (savings). The equity component looks to ensure benefits of the programs flow to historically marginalized communities as was mandated by the 2021 Climate Act. The electrification component prioritizes weatherization as part of the state’s electrification programs.

Performance-based Rates and the Inflation Reduction Act

Utilities will play a huge part in decarbonizing our grid. With the passage of the Inflation Reduction Act (IRA) and implementation of the rebates programs, we will see a historic investment in efficient electric technology. Now is the time for states to consider policies, such as PBR, that will complement these efforts.

PBRs offer the opportunity to directly align the utility business model with state equity and climate policy. States can incentivize utilities to work together in the deployment of IRA funds by encouraging installation of efficient electric appliances, braiding program funds, and ensuring equitable access to benefits. Laying the infrastructure now can ensure investments continue long after the Inflation Reduction Act has been fully implemented.