By David Lis | Thu, March 27, 25

Stunning views of Mount Saint Helens provided daily inspiration during my stay in Portland, Oregon while attending ACEEE’s Hot Water and Hot Air Forums. This is the third year ACEEE has gathered stakeholders from these two markets to come together to “discuss strategies for transforming the two biggest uses of energy in buildings”. I attended in early March with a few colleagues who each presented on different topics. The days were full of connecting, learning, strategizing, celebrating, and yes, sympathizing.

While session topics can often get quite specific and provide all the technical content a heat pump nerd could want, there were a few themes about the broader market and community of market actors that emerged as I reflected on the event. In no particular order, here are some of the major themes in the heating electrification market today:

Signs of Market Optimism Offset Federal Uncertainty

The conference came at a difficult time for many who work in energy-efficient heating and cooling markets and programs. With the recent change in federal leadership serving as a backdrop, many in the community of market transformers were experiencing “turbulence” brought on by rapidly shifting policies and guidelines from federal agencies overseeing programs like Home Energy Rebates, Greenhouse Gas Reduction Fund and others. Whether it was due to a direct freezing of funds, a pause in communications from agency staff, or back-and-forth guidance, many questions related to federally funded programs remained open. Having a chance to share the pains associated with this uncertainty provided a therapy session for the collective community.

While partners have been rattled by the uncertainty of federal programs designed to support heat pump growth, the conference reflected a steady optimism that these markets are on solid footing and poised to continue advancing. Panama Bartholomy from the Building Decarbonization Coalition, Steve Nadel from ACEEE, and NEEP’s own Erin Cosgrove reminded day two plenary attendees of both the progress and promise of the heat pump market. Each focused on key regions within the country that were carrying the leadership torch forward, from the California “region” to the Northeast and over to the Northwest.

The bottom line is clear: heat pumps outsell gas furnaces today and annual growth suggests that the gap will continue to widen.

And there are exciting programs happening to continue market growth. Groups of states are committing to 2030 goals, including those organized by the US Climate Alliance (USCA) and Northeast States for Coordinated Air Use Management (NESCAUM). Thirteen NESCAUM states aim for 65 percent market penetration of heat pumps by 2030, while 22 USCA states have committed to installing 20 million heat pumps. California’s Heat Pump Coalition set a goal of six million heat pumps sold by 2030.

States are doing more than just setting goals. The speakers highlighted the implementation of new programs and policies aimed at encouraging more adoption. NEEP’s Erin Cosgrove presented a series of implementation strategies happening in the Northeast region across four legs of a building decarbonization table. These strategies include utility planning and regulation, equity and workforce, codes and standards and carbon reduction obligations. The New England Heat Pump Accelerator also will provide a major opportunity for market transformation.

In the face of uncertainty, market data and regional progress show that the heat pump market is strong and growing.

Examining Operational Economics Alongside Upfront Costs

From the first session to the last, the issue of affordability stood out as THE issue of the week. While barriers related to upfront cost premiums of high efficiency air-source heat pumps (ASHP) and heat pump water heaters (HPWHs) are well known, the challenge of poor operational economics became front and center.

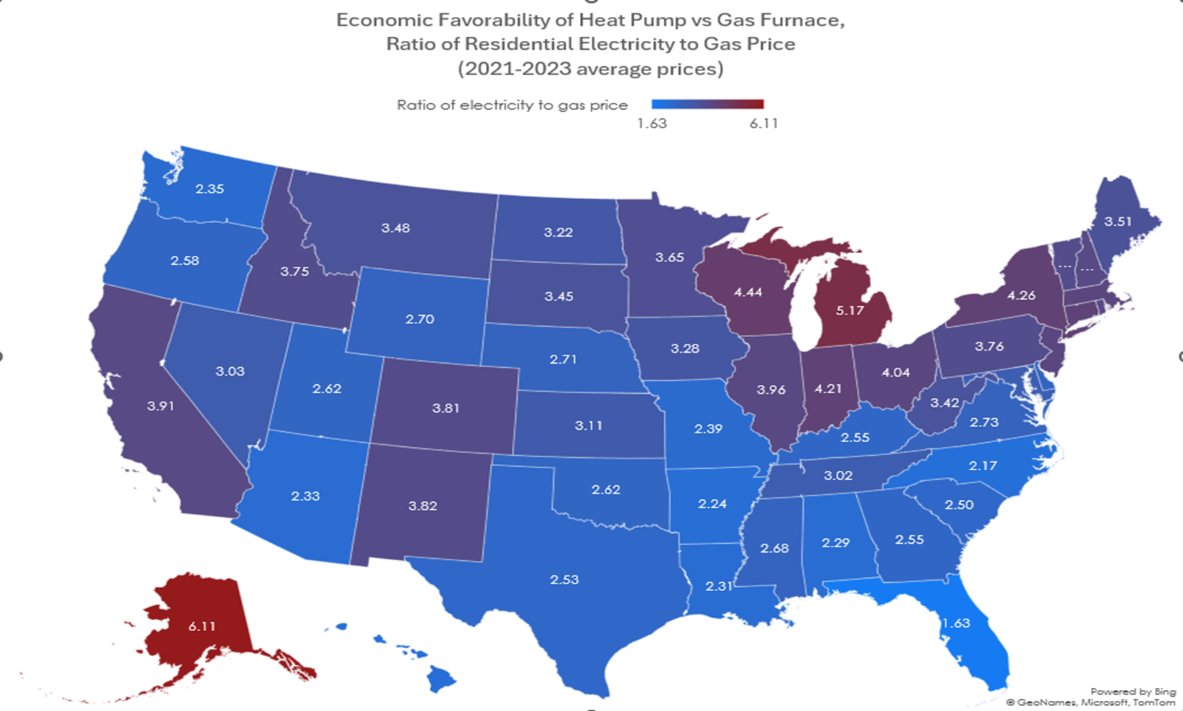

This challenge varies by state and region based in part on the ratio of a particular location’s electric rates to fossil fuel rates. This ratio is commonly referred to as the “spark ratio” or spread. In states and regions where the ratio is high (typically over three), like many households heating with natural gas in the Northeast, the economics to switch systems becomes less attractive. This challenge is most stark in some fuel switching scenarios, particularly for consumers considering retrofitting natural gas equipment with heat pumps. See map below for ratios of electric prices to gas prices across the US, with the caveat that these are based on state average prices – the economics may also vary by utility.

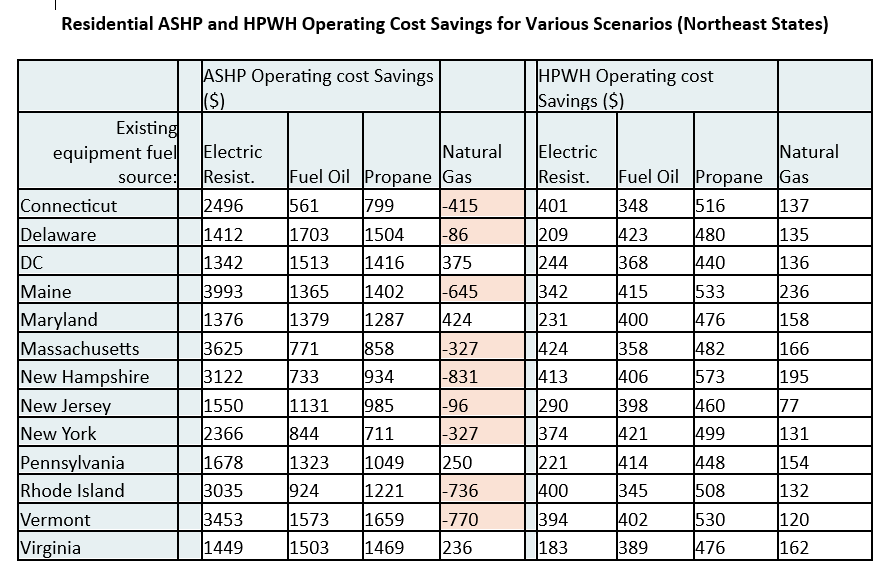

The chart below provides more detailed analysis of this challenge in Northeast states for residential ASHPs and HPWHs, pulling from two recent reports published by NESCAUM: Heat Pumps in the Northeast and Mid-Atlantic: Costs and Market Trends Report and Heat Pump Water Heaters in the Northeast and Mid-Atlantic: Cost and Market Trends Report. The chart indicates annual operating savings for residential customers switching from various heating fuels (electric resistance, fuel oil, propane and gas) to heat pumps. Red shading reflects an operating cost increase for customers switching to ASHPs. For this cost matrix, building vintage was assumed to be new, the baseline equipment scenario includes air conditioning operation, and EIA weighted average utility rates for electricity and natural gas were used. Heat pump performance was assumed to be at roughly ENERGY STAR levels.

Sources: NESCAUM’s Heat Pump Water Heaters in the Northeast and Mid-Atlantic: Costs and Market Trends Report and Heat Pumps in the Northeast and Mid-Atlantic: Costs and Market Trends Report

In the case of ASHPs, data from the Northeast demonstrates the significant cost savings opportunity for many households but cost increases for average gas customers in some states. Customers switching from gas furnaces to ASHPs will likely see an energy bill increase (i.e. negative savings) in many states. The conference sessions looking at a range of heat pump solutions reported similar economic challenges.

In the case of HPWHs, the efficiency advantage is much higher for HPWHs than fossil fueled water heaters, meaning that systems can overcome the spark ratio and deliver positive savings. In other words, households on average in each state will see significant energy savings in annual energy bills.

To address this, states have begun to explore shifts in electric rate structure that would make the operational economics more favorable to high efficiency electric equipment. For example, states and utilities in the Northeast have implemented “heat pump rates” for customers with heat pumps (see Maine and Massachusetts). These programs offer lower distribution rates in the winter season, often with slightly higher rates in the summer. I expect more states, especially those with high spark ratios, to consider special electric rates to alleviate this barrier for consumers.

Opportunities Arise With Emerging Technology Solutions

Electrification solutions are not a one size fits all. While residential ASHPs and HPWHs garner much attention, there is a growing stable of high efficiency electric space and water heating technologies available for all sectors and building types. NEEP highlights several of these in an Emerging Heat Pump Technologies brief.

Commercial packaged AC/HPs (or commonly referred to roof top units or RTUs) are ubiquitous across the country in commercial buildings. These systems most commonly pair gas furnaces and air conditioners in a single package to deliver heating and cooling. There are substantial opportunities to replace standalone air conditioners with a heat pump that provides cooling as well as some or all heating needs. Manufacturers are working with the U.S. Department of Energy and business leaders with large portfolios of buildings to make this solution the default instead of the exception, even in cold climates.

Large air-to-water (ATW) heat pumps for space conditioning and large commercial HPWH for domestic water heating are also emerging solutions increasingly applied to commercial and multifamily buildings. ATW heat pumps offer an exciting retrofit solution to existing buildings that have hydronic distribution systems. Affordability, across upfront and operational perspectives, continues to be a major barrier to widescale adoption.

Smaller unitized heat pump form factors are also emerging as important solutions, particularly for multifamily buildings. Organizations from across the country are field testing new room heat pumps that can be easily installed in windows, providing newfound savings and comfort. Early results have been exciting.

A Model of Heat Pump Success

TECH Clean California is a statewide initiative to accelerate the adoption of clean space and water heating technology across the state. During several sessions, the implementation team shared various program impacts and insights using an extensive data set gathered over the first few years of the program. From demographic information, to customer satisfaction, to contractor details, to installed costs and rebate dollars, the data sets can be mined for critical insights. With over 50,000 units installed, 1000 contractors enrolled, and $116 million in incentives paid, the data can be used to analyze what is working, where, and why. This gives the program and stakeholders the opportunity to quickly learn and refine the program for maximum impact. The TECH program built this data collection/analysis function into the program from the start. It’s a model that should be prioritized by new and existing programs across the country to provide transparency, accountability and the critical ability to continuously improve outcomes.

The Heat Pump Market Is Strong And Growing

While uncertainty at federal agencies and programs have created a lot of anxiety within the community advancing high efficiency space and water heating, the market remains strong, with regional and state efforts providing clear tangible pathways towards continued market success.

NEEP will continue to provide leadership and support to the Northeast as our states forge ahead with nation-leading market development efforts. If you want more insights into the current heat pump market and opportunities for growth, it's possible that NEEP might be publishing a report in the not-too-distant future….wink, wink. Stay tuned for more!

And if you need a restaurant recommendation in Portland, try the golubtsi at the Russian restaurant Kachka. See everyone next year in Phoenix.