By Brian Buckley | Fri, December 18, 15

In a major departure from traditional thinking that often compartmentalized energy efficiency efforts in a way which limits cross-fuel subsidization, Vermont is in the midst of promulgating final regulations for Act 56. This potentially-landmark bill would encourage the state’s utilities to sell more MWh’s by, amongst other things, electrifying the heating and transportation sectors.

It’s no secret that regulators in states like New York, California, Hawaii, and Minnesota are reevaluating how electric utilities do business in the context of a rapidly modernizing electric grid. Distribution system investments required to accommodate bidirectional power flows —coupled with eroding revenue bases resulting from the proliferation of distributed energy resources — have left utilities, regulators, and legislators throughout the country asking how to bring our grid into the 21st century without dramatically impacting customer rates.

As other states continue their debates, Vermont is pioneering a solution.

Act 56 in a Nutshell

Act 56 isn’t just about electrification; it’s about energy transformation. The legislation establishes three Tiers of requirements for Vermont’s Distribution Utilities:

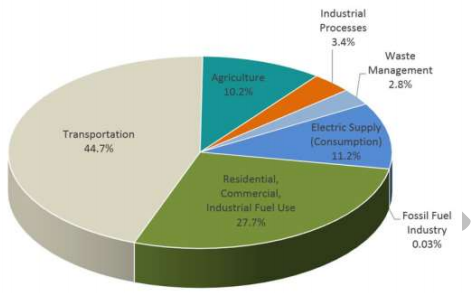

Tier I - Total Renewable Electric Requirement - Requires that renewable energy credits be retained in-state to count toward meeting the state’s new renewable portfolio standard. The state’s previous goals allowed Vermont’s retail service providers to subsidize electric rates by selling renewable energy credits out of state, while also count them toward in-state renewable portfolio requirements of 55% by 2017 and 75% by 2032. As a result of these requirements, Vermont is uniquely positioned to engage in fuel switching, since the carbon footprint of their electric sector comparable to other fuels is already quite low.

Tier I - Total Renewable Electric Requirement - Requires that renewable energy credits be retained in-state to count toward meeting the state’s new renewable portfolio standard. The state’s previous goals allowed Vermont’s retail service providers to subsidize electric rates by selling renewable energy credits out of state, while also count them toward in-state renewable portfolio requirements of 55% by 2017 and 75% by 2032. As a result of these requirements, Vermont is uniquely positioned to engage in fuel switching, since the carbon footprint of their electric sector comparable to other fuels is already quite low.

- Tier II - Distributed Generation - Sets targets for new distributed generation at 1% of sales in 2017, rising incrementally to 10% by 2032. New distributed generation satisfying Tier II in excess of the prescribed portfolio can also count toward satisfaction of Tier III.

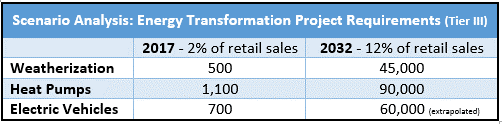

- Tier III - Energy Transformation - Sets targets for fossil fuel consumption reductions by distribution utilities at 2% of retail sales in 2017, rising incrementally to 12% of retail sales in 2032, with requirements for small municipal utilities differing slightly. Distribution utilities are encouraged to partner with third parties, including the state’s Energy Efficiency Utility — Efficiency Vermont — to achieve Tier III’s goals. Like energy efficiency measures, Energy Transformation Projects will be screened for lifecycle cost-effectiveness under the societal cost test and against an alternative compliance payment of $0.06/Kwh, adjusted for inflation. Projects satisfying the energy transformation requirement include, but are not limited to:

- Home weatherization or other thermal energy efficiency measures;

- Air source or geothermal heat pumps;

- High efficiency heating systems;

- Increased use of biofuels;

- Biomass heating systems;

- Support for transportation demand management strategies;

- Support for electric vehicles or related infrastructure; and

- Infrastructure for the storage of renewable energy on the electric grid

The chart to the right summarizes initial modeling provided by the Department of Public Service in their draft 2015 Comprehensive Energy Plan approximating a scenario where weatherization projects, heat pump installations, and electric vehicle purchases collectively satisfy the energy transformation project requirements.

According to Liz Gamache, Director of Efficiency Vermont, “The energy transformation requirement in Vermont's Renewable Energy Standard is an exciting opportunity for Vermont's electric utilities and efficiency providers, including Efficiency Vermont, to look at the State's energy comprehensively and reduce fossil fuel consumption and greenhouse gas emissions through initiatives like transportation demand management and electrification, thermal efficiency, and even land use planning.”

“We look forward to partnering with distribution utilities and other stakeholders to develop and deliver programs to benefit Vermonters, the local and regional economy and the environment,” says Gamache.

Bill and Rate Impacts of Energy Transformation Projects

The Vermont Department of Public Service notes that “Strategic electrification resulting from energy transformation projects has the potential to lower electric rates by utilizing our existing electric infrastructure more completely.” For example, an early analysis of the legislation concluded the energy transformation project requirement would actually lower rates for consumers, resulting in 2% lower rates by 2024, and 4.5% lower rates by 2032.

In many cases, switching from oil and gas to electricity will reduce overall customer bills and improve environmental health, and increasing electric usage would reduce per kWh distribution costs by spreading fixed transmission and distribution system costs across more kWhs. But how would strategic electrification utilize our existing infrastructure more completely, while avoiding costly peak demand?

Strategic electrification can help mountain-top mine our daily electric load profile.

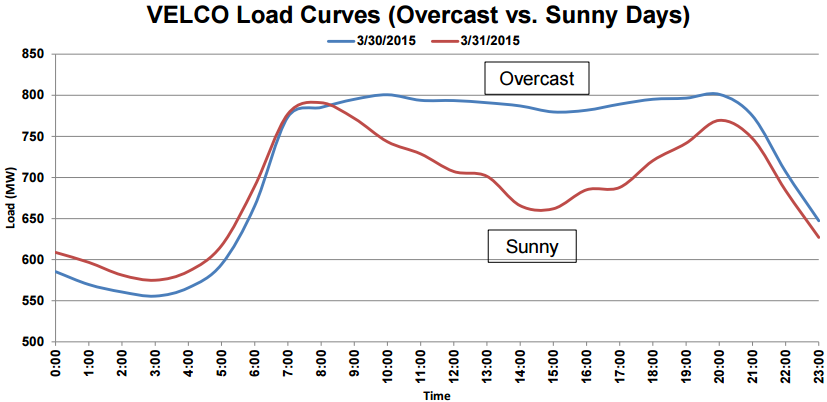

Our electric distribution grid is built primarily to accommodate short periods during just a few days of the year when demand on the grid reaches toward its peak capacity. As pictured to the right, in Vermont those hours are typically around 8am and 8pm. If instead, the system peaks could be leveled with battery storage and the valleys filled with price-responsive electric vehicle charging and heat-pump appliances, our electric grid would have lower per kWh costs.

While technologies already exist that could enable automated vehicle to grid demand response and other promising solutions, innovative public policies will be key to their adoption. This is especially feasible in a place like Vermont, where advanced metering infrastructure exists in more than 90 percent of the state, and responses to policy levers can be measured, verified and evaluated.

As more regulators begin to embrace policies around strategic electrification, time varying rates, critical peak pricing, and distribution level demand response, our electric grid and utilities may indeed survive — and thrive — during a transition that many have forecasted as the utility “death spiral.” In fact, we’re beginning to see such policies surface throughout the country.

Regional Actors Charting a Similar Path

In states like New York, Rhode Island, Massachusetts, and California, leadership at the executive level is forging a path toward strategic electrification. Below is a summary of some of their exemplary policies:

- New York - NYSERDA’s recent Clean Energy Fund Proposal has suggested fuel neutrality as a key attribute of their investment portfolio. While the policy has yet to gain the formal approval of regulators, it would open to the door for strategic electrification initiatives and enable the state to achieve the ambitious targets set forth in their 2015 State Energy Plan.

- Rhode Island - Rhode Island’s Draft Long Term Energy Plan, known as Energy 2035, suggests the expansion of the utility least cost integrated resource planning to unregulated fuels. Such an expansion would open the door for strategic electrification projects. Within this context, the Rhode Island Office of Energy Resources recently convened a System Integration Rhode Island (SIRI) working group, with recommendations for strategic electrification forthcoming.

- Massachusetts - The Massachusetts Department of Energy Resources has been contemplating revision of residential conservations services regulations, which may expand funding for fuel neutral energy efficiency improvements.

- California- Recently passed legislation in California directs the adoption of “Appropriate policies, rules, or regulations to remove regulatory disincentives preventing retail sellers and local publicly owned electric utilities from facilitating the achievement of greenhouse gas emission reductions in other sectors through increased investments in transportation electrification.”

Some of the above-referenced jurisdictions might benefit from the early groundwork being laid in Vermont, including creation of a recently published energy transformation project planning tool. NEEP certainly will be keeping a close eye on Docket 8550, and its potential to drastically change the way the region’s consumers access energy services.