By Tara McElhinney | Wed, May 24, 23

If you’ve been following the world of heat pumps, you know this past year has seen a lot of changes, from new minimum efficiency metrics (SEER2/HSPF2) to an influx of public funding to support heat pump adoption. How are states in the Northeast and Mid-Atlantic incorporating these changes into their programs?

In this post, we’ll explore the forces affecting the heat pump market and some resulting trends in state-level heat pump incentive programs, including technology and equity considerations.

Unprecedented Levels of Funding

With the passage of the Inflation Reduction Act of 2022 (IRA) came monumental investment toward energy security and climate change action. $369 billion will make its way through state and federal agencies to promote clean energy resources and energy efficiency technologies, including heat pumps. The IRA provides significant funding above and beyond what regional programs are already offering. Learn more about how the IRA and the Bipartisan Infrastructure Law (BIL) will affect the market broadly on our Federal Policy Resources page.

This new source of energy efficiency dollars allows for state programs to increase incentives for consumers and contractors to install clean heating and cooling technology.

Though states are expanding heat pump incentive programs, keep in mind there are still household caps written into the laws.

Shifting Landscape of Specifications

DOE New Minimum Efficiency Standards

Starting in January 2023, the U.S. Department of Energy implemented new minimum efficiency metrics and related standards that require HVAC manufacturers to shift to producing more efficient air conditioning (AC) and heat pump (HP) equipment. These are colloquially known as “M1” metrics, and they are meant to be more representative of performance in homes.

Before 2023, SEER, EER, and HSPF were used as efficiency metrics, which many entities like NEEP’s Cold Climate Air Source Heat Pump List and individual state heat pump rebate programs leveraged to ensure high performance, efficiency, and comfort in cold climates. Now, SEER2, EER2, and HSPF2 are the industry standard metrics.

So, what happens to all the heat pumps in inventory that are still rated to the older “M” standards? Well, these models are not obsolete. Many are being retested to the new efficiency standards, and others are being redesigned. To give time for the M1 transition, many states are allowing a yearlong grace period. For example, Mass Save writes:

“Effective January 1, 2023, the federal government will be issuing new standards for heat pump products which will cause manufacturers to replace HSPF and SEER efficiency ratings with HSPF2 and SEER2. At that time, the Sponsors of Mass Save will update efficiency requirements for residentially sized air source heat pump equipment (rated below 65,000 Btu/h of cooling capacity) to align with the new federal standards (i.e., ENERGY STAR 6.1 Cold Climate Certification standard). To ease the transition to the new standards, the Sponsors will consider any models that meet either the current criteria or the new criteria as eligible for installation through December 31, 2023. For more information click here.”

We are seeing similar transition periods across other state programs to allow the market to catch up to the changes.

ENERGY STAR

In another new development, U.S. EPA’s ENERGY STAR launched a cold-climate rating for heat pumps. The ENERGY STAR 6.1 Cold Climate Certification standard indicates the heat pump is optimized for peak heating and part-load cooling performance. Many programs in the Northeast are aligning new 2023 program requirements with the 6.1 Cold Climate standards.

CEE

The Consortium for Energy Efficiency (CEE) is also changing the spec game. CEE introduced their 2023 efficiency tiers which are tied to Section 25C tax credits, also known as the Energy Efficient Home Improvement Credit.

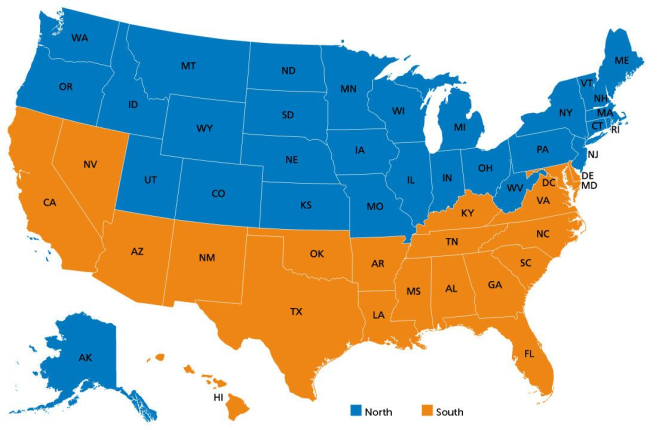

The tiers indicate increasing energy performance starting with CEE Tier 1, increasing to CEE Tier 2 and finally to the highest performers, CEE Advanced Tier. For heat pumps in the North and Canada, CEE specs are generally more stringent than both ENERGY STAR V 6.1 Cold Climate and NEEP’s Cold Climate Air Source Heat Pump Specification V 4.0.

Incentivizing this level of efficiency signals the market to design, produce, sell, and install higher efficiency heat pump units. The entire specification landscape is trending towards high efficiency standards to ensure heat pumps are performing well in cold climates in order to reduce grid load and increase customer comfort.

Technology

In general, we are not seeing drastic changes in the types of heat pump being incentivized by state residential incentive programs. Many rebate-eligible heat pumps are air-to-air heat pumps, with a good chunk of ground source products mixed in, consistent with what we saw in 2022. We’ve started to see air-to-water heat pumps (i.e. Vermont, Massachusetts) gaining traction in programs, but this technology is still not incentivized widely.

FirstEnergy is helping to pave the way in Pennsylvania, providing rebates for ENERGY STAR certified air-to-water heat pumps combined with domestic hot water. We may see an uptick of incentives for combined systems like these as they start to grow in the market.

It’s important to note that many states also offer complementary weatherization assistance programs, which are important for reducing home energy costs and reducing the load on the grid.

Workforce Training

As heat pump incentivization and adoption grows, so must the informed workforce that installs them. System performance, comfort, and energy efficiency depend heavily on proper sizing, system selection, and installation practices.

State programs recognize the need for high quality installation, and some have tied incentives directly to certified installers. For example, New York state rebate programs require air source (ASHP) and ground source heat pumps (GSHP) to be installed by a contractor certified with the NYSERDA Clean Heat Program. The contractor works with the customer, leveraging NYSERDA’s compilation of resources for education, including NEEP’s ccASHP List, installer guides, and sizing tool. Several other states require or encourage a list of qualifying contractors.

This indicates that installer training programs and quality installation practices are paramount to states as they electrify.

Energy Equity

With the knowledge that Black, Brown, Indigenous, and low-income communities suffer from energy inequities (higher energy burden, higher rates of pollution, disproportionate health impacts), it’s important to center equity in program design.

Many states are offering additional or greater incentives to underserved communities. Take the following program designs, for example (non-exhaustive list):

- Mass Save offers increased incentives to low-income households for ASHPs and GSHPs

- Rhode Island Energy offers no-cost appliance upgrades for eligible households, including replacement heating systems

- EmPower NY provides income-eligible NY residents with no-cost energy efficiency solutions, including the installation of clean heating and cooling heat pumps.

- Pennsylvania’s State Energy Program is implementing a new high-efficiency electric home rebate for low- and moderate-income households geared toward heat pump rebates

- Efficiency Vermont offers bonus rebates for income-eligible customers installing clean heating technologies

- Jersey Central offers enhanced rebates for income-eligible customers installing heat pumps

- Though not a state program, our neighbors to the North at efficiencyPEI offer income-eligible customers rebates for energy efficient heating equipment

What’s Next?

While residential heating electrification programs are ramping up, causing a shift in efficiency requirements and centering equity and justice, there are more changes to come. More federal money will be coming as states set up programs to implement other energy-efficient programs like the High-Efficiency Electric Home Rebate Act (HEEHRA). This program, in particular, will boost energy equity for low- to moderate-income households.

Another development to keep an eye on is the U.S. Environmental Protection Agency (EPA) hydrofluorocarbon (HFC) refrigerant phase out. The EPA will require manufacturers to phase out high-GWP (Global Warming Potential) refrigerants. As the refrigerant commonly used in heat pumps, R410-A, is pushed out of the market in the coming years, manufacturers will be designing new systems using alternative refrigerants. The only way to know how this will affect residential heat pump programs is to stay tuned!

Stay in the loop on program updates through our Heating Electrification initiative. Updated Residential and Commercial Heating Electrification Program trackers will soon be available to initiative subscribers. Contact Tara McElhinney, Dave Lis, and Deepti Dutt for all things space and water heating at NEEP.